should i form an llc for one rental property

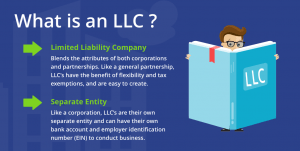

The LLC has its own EIN. Whether you have one or more the benefits are basically the same.

Should You Put Your Rental Properties In An Llc

When you own rental property its usually a good idea to hold it in the name of an LLC to help limit your liability and build credit for your real estate business.

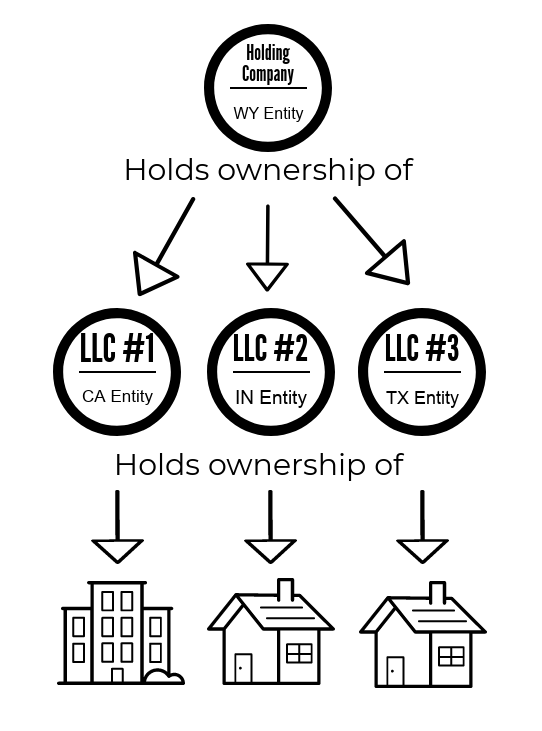

. You can also form an LLC for each rental property that you hold. The following info is from. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

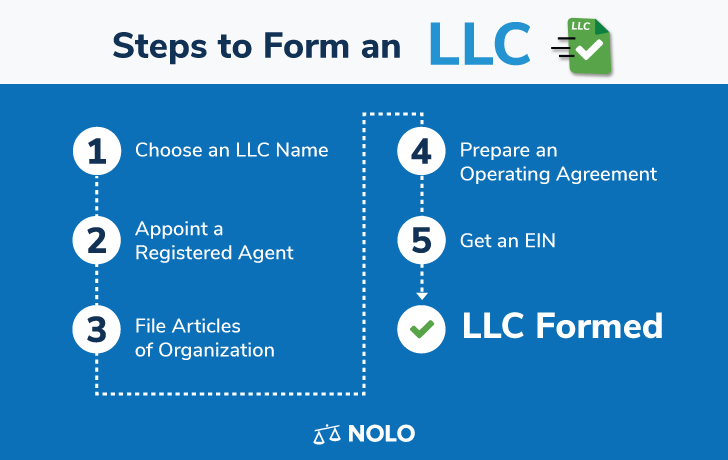

Benefits of an LLC for a rental property. Answer 1 of 10. To form an LLC you will need to complete a few steps.

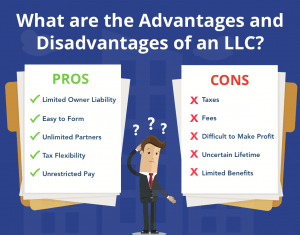

They would be forced to. Excellent Liability Protection. An LLC for rental property may be a good way to protect other business and personal assets from creditor claims and to raise funds for group investing.

Before you file LLC formation paperwork for your rental company take time to consider the needs of your. As these forms vary from state to state youll want to. With one property deed per LLC you can manage multiple properties.

You can do an internet search or go to your county recorders office to get your forms. The average cost of forming an LLC ranges from 50 to 500. Make sure you have the.

The renter was the Army Corp of Engineers and did issue a 1099-misc for the rent paid with the EIN of the llc associated. By comparison a real estate trust may. That means any lawsuit relating to the property will only put at risk the property or properties owned by the llc.

By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party. Complete and submit the required paperwork. As a business owner a Florida Rental Property LLC is designed to limit your personal liability and provide asset protection in the event of litigation.

Also there are expenses i. There are many reasons why property owners may choose to form an LLC to manage their rental properties. Before you file llc.

So Ohios laws and tax rules. The LLC owner will likely have to foreign qualify the LLC in Ohio because thats where the business of renting the property is being conducted. Separate Your Rental Properties.

Is a business structure. Go through the proper channels to create a company. The cost of forming an LLC is relatively low but it can vary depending on the state you choose to form in.

Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. You should seriously consider creating an LLC even if you have one property.

How To Invest In Real Estate The Motley Fool

Reasons Not To Use An Llc For Rental Property Biggerpockets Blog

How To Get A Mortgage For Llc Owned Properties

Az Big Media How To Transfer Rental Property To Llc Az Big Media

Llc In Real Estate Pros And Cons Nestapple New York

How To Create An Llc For A Rental Property With Pictures

Should I Form An Llc For My Beach Rental The Legal Scoop On Southwest Florida Real Estate

What Are The Pros Cons Of Using An Llc For Rental Property

Should I Transfer The Title On My Rental Property To An Llc

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Llc In Real Estate Pros And Cons Nestapple New York

Llc In Real Estate Pros And Cons Nestapple New York

Why You Should Form An Llc For Your Rental Property

Benefits Of Forming An Llc For Your Property G G Law Offices

Should You Put Rental Properties In An Llc Umbrella Llc For Real Estate Passive Income

What Is An Llc Limited Liability Company Nolo Nolo

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

Should I Create An Llc For My Rental Property

Best Rental Property Spreadsheet Template For Download Monday Com Blog